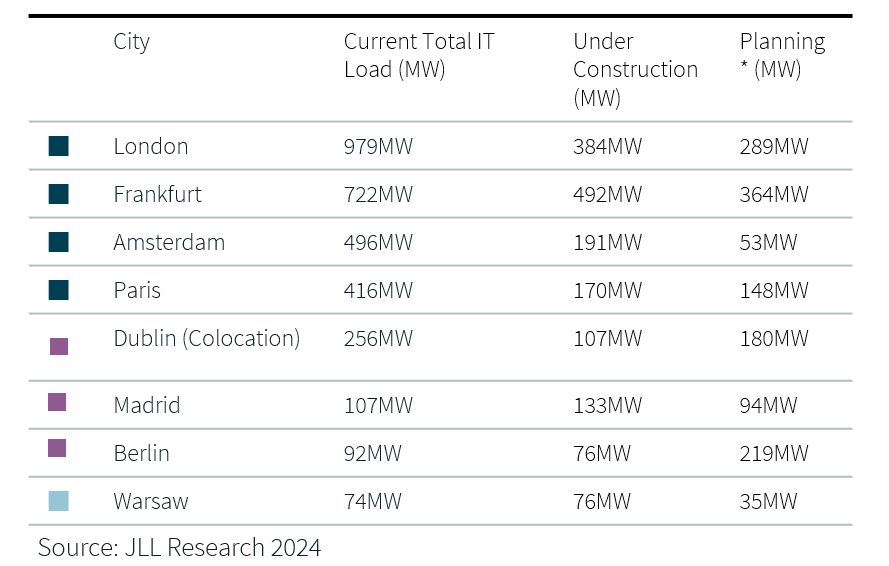

JLL’s new EMEA Data Centre report shows strong data centre demand shifting focus to new markets. In 2024, there will be a 16% increase in data centre supply with 467MW added to Europe’s core markets of Frankfurt, London, Amsterdam, Paris, and Dublin (FLAPD). Secondary markets will also see significant growth in 2024, with Madrid, Berlin and Warsaw set to see an average 49% increase to their market size. Madrid alone is expected to have 58MW of new supply added.

According to JLL’s Data Centre report, 2023 was an exceptional year, with record take up for data centres across the FLAPD markets, which reached 352MW, a 19% YoY increase. A total of 391MW of new supply came online, with 161MW added in the last quarter alone – the biggest yearly increase seen with the core market size growing by 16 %. Frankfurt dominated 2023 both by market growth and take up, which saw 119MW of take up (20% up YoY) and 134MW of new supply (51% up YoY). This will continue to be the case in 2024, however we will see London make a comeback after a year of comparatively low market growth.

Pre-leasing activity also remained high, with a total of 511MW of pre-lets in 2023, a 6% YoY increase. Falling vacancy rates led to average colocation rents rising between 9% and 13%. Investment in the sector more than doubled in 2023, reaching $2.34bn in Europe up from $0.76bn in 2022.

Tom Glover, Head of Data Centre Transactions, EMEA, JLL, said: “In a world increasingly fuelled by the internet, data, and artificial intelligence, demand will continue to rise for the real estate to make it all happen. We saw record levels of take up, demand and preleasing for data centres in 2023, and expect 2024 to be another staggering year for activity in the sector.

Data centre demand shows no sign of deceleration. Power availability and increasingly tough sustainability performance regulations and reporting requirements are beginning to drive activity in Europe’s secondary markets.”

Secondary and emerging markets gain ground

Berlin, Madrid, and Warsaw are forecast to grow by 39%, 54% and 59% respectively. In 2023 alone, 23MW of new supply was added in Madrid, a 27% increase in market size. Tertiary or emerging markets are also expected to grow by an average of 17%. In Southern Europe and the Nordics, markets are set to grow between 30-55% over the year ahead.

Daniel Thorpe, Data Centre Research Lead, EMEA, JLL, added: “While we saw additional supply come to market, it’s still struggling to keep pace with the staggering levels of demand for data centre capacity, creating an ongoing imbalance. We expect demand for space in 2024 will continue to be incredibly high, particularly in core markets, leading to low vacancy rates for new space and upward pressure on rents.

We predict that data centre developments will expand to locations where there is available power and land, meaning secondary and emerging markets, particularly in Southern Europe and the Nordics, will be critical in countering supply challenges.”